Dansko Shoes for Women – 21 styles and models that deliver comfort!

You may be familiar with Dansko shoes, a brand that has become renowned in the world of comfortable footwear. Many of us know and love the iconic Dansko Professional clog. What’s new is the ever-expanding line of other Dansko shoes which includes sneakers, sandals, boots, and versatile business-casual styles.

Did you know Dansko shoes also played an important role in the coming-to-be of this website over 13 years ago? Check out the full story below. But first let’s look at shoes. Here is a selection of some our favorite current Dansko styles:

Sneakers:

Henriette, one of our favorite Dansko sneakers, has a lot of features to love including:

- A removable insole which accommodates most orthotics

- Memory foam footbed featuring Dansko Natural Arch technology (a proprietary technology providing extra arch support to the footbed)

- Adjustable bungee laces for a customized fit

- Roomy toe box

- Versatile styling

- Loved by online reviewers dealing with a myriad of foot, knee, hip and back conditions, some of whom have had trouble finding ANY shoe that works for them

- Sizes 5.5-11.5, $120 from Dansko and Zappos

Paisley, a waterproof shoe perfect for the trails that accommodates most standard and custom orthotics–other foot-friendly features:

- Waterproof uppers treated with 3M Scotchgard™ for stain resistance.

- Removable, triple-density footbed with Dansko Natural Arch technology.

- Slip-resistant Vibram rubber outsole.

- Sizes 5.5-11.5, $150 from Dansko, Zappos and Amazon. Also available in WIDES!

Boots:

Shelia, a knee high boot with a walkable 2″ wedge heel and:

- She’s waterproof!

- Shelia features removable cushioned insole

- 15″ calf circumference

- Sizes 5.5-11.5, $210 from Dansko, Zappos and Nordstrom

Barbara is a versatile boot with similarities to the traditional Dansko clog, plus:

- Fashionable ankle-boot styling

- Roomy toe box

- Cushioned insole

- Side zipper for easy on/off

- Lightweight, flexible EVA outsole

- Many online reviewers who love how stylish this boot is, saying how cute it is with absolutely everything from jeans to dresses, skirts & leggings

- Sizes 5.5-12.5, $175 from Dansko and Amazon.

Sigourney is the perfect out-and-about boot. Here’s why:

Season is a sandal that has garnered 5-star reviews from hundreds of online reviewers. Here’s why:

- Classic, timeless styling that is versatile and practical

- A cushioned, supportive footbed with smooth, breathable leather linings

- Lightweight polyurethane outsole

- Two adjustable hook-and-loop straps at ankle and toe for a customized fit

- Has received the American Podiatric Medical Association (APMA) Seal of Acceptance for footwear found to promote good foot health

- High level of comfort, even for people experiencing painful foot, leg, and back issues

- Sizes 4.5-12.5, $89-120 from Dansko, Zappos and Amazon.

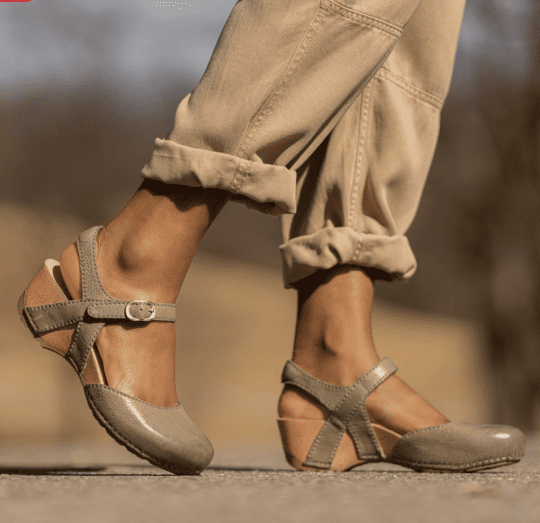

Tiffani is a sleek heeled sandal that’s easily dressed up or down and features:

- A closed toe, perfect if you prefer to keep your tootsies under wraps

- Hook and loop closure (buckle is decorative)

- Lightweight midsole

- Sizes 5.5-11.5 for $95-140 from Dansko, Zappos and Amazon.

Reece, a lovely classic sandal style, has:

- A non-irritating toe loop. Even reviewers who were concerned about the loop had no issues. “I don’t usually like anything between my toes but I don’t even notice the loop,” says one reviewer. Many others echo these sentiments

- Sleek, lightweight styling

- Adjustable hook-and-loop fasteners

- Molded memory foam footbed with breathable leather lining

- Good arch support

- A profile that may be more accommodating to narrower feet than some other Dansko styles

- Sizes 5.5-11.5 for $90-130 from Dansko, Zappos and Amazon.

Rowan Is perfect hybrid of casual sandal and closed-toe shoe. It’s a crowd pleaser with many 5-star reviews.

- A practical closed-toe design

- Dansko Natural Arch technology for good support

- Cork and EVA midsole molds to foot shape

- A layer of memory foam for extra cushioning

- Sizes 5.5-11.5 for $69-120 from Dansko, Zappos, and Amazon.

Clogs and Mules:

Dansko Pro clogs are probably the most well-known Dansko shoes. Many of you might be familiar with this style, but you may not know that Dansko offers three unique collections of this iconic stapled clog – the Professional, and the XP 2.0. Each provides specific performance features and benefits. To learn more and find out which clog best suits your needs, click here.

We’re featuring the Dansko XP 2.0, which is unique among the other Dansko clog lines for its:

- Lightweight EVA midsole

- Leather sock liner with 6mm of Energy Return PU (which provides a welcome springy-cushiony feel)

- EVA outsole, which contributes to shock absorption and an overall lighter weight

- Sizes 5.5-11.5 for $125-140 from Dansko, Zappos, and The Walking Company.

Pearson is the big buckle cousin of the classic Professional clog featuring:

- The support of the classic Pro clog with a layer of cushioning foam.

- Updated hardware features a decorative buckle engraved with year Dansko was established

- Roomy toe box and rocker sole.

- Available in sizes 5.5-11.5 for $145 from Dansko.

Merrin joins the Dansko line up as a thoughtfully crafted mule with:

- a midsole made of sustainable and durable cork

- Soft lining with 100% recycled textile treated with anti-microbial for odor control

- Removable insole with Dansko Natural Arch technology

- Stable wedge heel

- Hook and loop closure

- Available in sizes 5.5-11.5 for $145 from Dansko, Zappos, and Amazon.

Sheridan is good for all seasons with its waterproof leather upper, water resistant leather stacked heel and rubber outsole. Other reasons to love Sheridan:

- Removable PU and memory foam footbed

- Dansko Natural Arch® technology for all-day comfort and support

- Two inch wedge heel with .75 inch platform

- Available in sizes 5.5-11.5 for $150 from Dansko and Nordstrom.

Wide Width Shoes:

If you have wide feet, know that the classic Dansko Professional clog is available in a wide width. In addition to clogs, here are some other Dansko shoes that come in wide widths:

Honor is a versatile casual shoe that also has:

- A contoured, removable footbed with memory foam and moderate arch support

- The APMA Seal of Acceptance for footwear found to promote good foot health

- A convenient quick-lacing system with a bungee and toggle. (This feature is loved by lots of online reviewers for its ease, but especially appreciated by those with a narrower-heel/wider-forefoot combination who find it provides a great fit)

- Lightweight EVA midsole with Strobel construction for added flexibility

- Sizes 4.5-12.5, medium and wide widths, $110 from Dansko and Zappos.

Paisley features hiking-inspired styling and:

- Waterproof, 3M Scotchguard treated uppers

- Removable, triple-density footbed that accommodates most standard and custom orthotics

- Roomy toe box

- Slip-resistant Vibram rubber outsole

- Rave reviews from wearers with everything from “typical” feet to complicated foot and knee problems

- Happy reports from reviewers who say the Paisley is flattering on larger feet

- Available in sizes 5.5-11.5, medium and wide widths, $145 from Dansko and Zappos.

Franny is a dressier style perfect for work or fun, featuring:

- Supple leather uppers with a hook-and-loop strap and elastic lace closure for adjustability

- Perfect 1 1/2” heel height

- Combination of comfort and stylishness perfect for teachers, travelers, medical professionals, retail workers, or anyone who spends a lot of time on their feet but wants to look polished

- Removable insoles (attested to by reviewers, though not stated in the shoe description)

- 5-star rave reviews from many online reviewers, including those who “never write reviews” but had to chime in about how much they love this shoe. Here are some of their comments: “These shoes feel like heaven.” “Great for feet with bunions.” “Finally, comfortable walking shoes that are also nice looking.”

- Sizes 5.5-11.5, medium and wide widths, $135 from Dansko, Zappos.

Now that we’ve completed our roundup, here’s a little more about why the Dansko shoes brand is so close to the heart of Barking Dog Shoes:

This blog was founded by Kirsten Borrink, who was diagnosed with rheumatoid arthritis in her 20s at which time she was a healthy, active junior high Spanish teacher. Suddenly she was confronted with feet that felt like they had daggers in them whenever she moved. The pain made even basic classroom tasks excruciatingly painful. Desperate to help ease her discomfort and find a way to keep teaching, she spent a long time searching for shoes in a department store known for its very large shoe selection. It was a failed effort that left her feeling overwhelmed and discouraged.

Thankfully Kirsten stopped into a smaller shoe store nearby and encountered a helpful clerk who introduced her to the Dansko brand. She recalls slipping her feet into a simple black Mary Jane clog that provided instant relief for her foot pain and, finally, a sense of hope. It seemed like fate when she turned over the shoe and saw the name of the style – “Kirsten.” Her very own name. (The Dansko Kirsten style has since been retired, but the Dansko Sam is very similar.) Kirsten started reviewing comfortable shoes for women in 2007, figuring there were probably many other people out there with struggles similar to her own who would welcome some guidance. Barking Dog Shoes has featured Dansko shoes regularly over the years for their consistent high level of quality and reliable comfort, as well as the brand’s adaptability to changing style trends.

Needless to say, there are many more styles of Dansko shoes available than we can feature in one post. To see the full line, go to Dansko.com.