Browsing the "Sandals for Plantar Fasciitis" Category

Oofos OOlala Sandal Review: Video Review

September 11th, 2024 | by Kirsten Borrink

I recently purchased the Oofos Oolala Sandal, and I have to say, it’s been a game-changer for my post-surgery feet.

Sandals With Arch Support: 9 Picks for Sure Comfort All Summer Long

July 22nd, 2024 | by Kirsten Borrink

Those of us in cooler climates look forward to sandal season all year long – that sometimes too-brief window of

Taos Trulie Sandal Review: A Truly Comfortable Sandal

June 6th, 2024 | by Kirsten Borrink

This review of the Taos Trulie sandal is sponsored by Taos Footwear. The opinions are completely my own based on experience.

Stegmann Layna Wedge Review

May 11th, 2024 | by Kirsten Borrink

What are the creative folks up to at Stegmann these days? Releasing new styles into their collection of exceptionally comfortable,

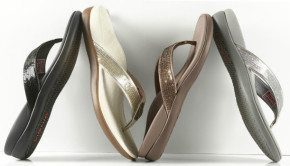

Vionic Tide Sequins Review

July 2nd, 2023 | by Kirsten Borrink

I remember visiting friends in Little Rock, Arkansas last summer and noticing many women in sparkly flip-flops. Tweens, teens, their

Vionic Sandals Offer Enhanced Arch Support – See Our Top Picks!

March 18th, 2023 | by Kirsten Borrink

No matter your style aesthetic, there is a pair of Vionic sandals for you! Heralded for their terrific support and

Spenco Sandals – Total Support, Lightweight Yumi Sandal

July 25th, 2022 | by Kirsten Borrink

Spenco Sandals You’ve heard of Spenco insoles, but did you know they make supportive sandals designed to alleviate foot problems

Reader Request: 5 Plantar Fasciitis Sandals with Style and Support

June 1st, 2022 | by Kirsten Borrink

Plantar Faciitis sandals – which are the best? See Kirsten’s recommendations to a reader’s request… Hello, Kirsten! I have been